child tax credit october 15

Free means free and IRS e-file is included. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

October Thirty One Canvas Bag Thirty One Gifts Thirty One Thirty One Fall

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have started.

. Child tax credit payments worth up to 300 will be deposited from October 15 Credit. Learn More at AARP. The first three payments were sent on July 15 August 13 and September 15 while the.

The IRS will send out the next round of child tax credit payments on October. We dont make judgments or prescribe specific policies. As part of the.

Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return. The deadline to exclude yourself from child tax credit advance payments is next November 1 at 1159 pm ET.

6 Often Overlooked Tax Breaks You Dont Want to Miss. As you may know the American Rescue Plan dramatically expanded the Child Tax Credit CTC to a maximum of. They could also get up to 250 per qualifying child between 6 and 17 years or a total of 3000.

Millions of families should soon receive their fourth enhanced child. Under the American Rescue Plan the maximum child tax credit rose to 3000 from 2000 per child for children ages 6 and older and it rose to 3600 from 2000 for children. The credit tops out at 3000 for children between 6 and 17 years old.

Picture of a US. Parents should have received another round of monthly child tax credit payments recently. First families can expect some treats since the fourth round of advance monthly payments for the child tax credit are scheduled to arrive Oct.

October 15 2021 at 715 am. When will I receive the monthly Child Tax Credit payment. Parents with dependents between 18 and 24.

By Tami Luhby CNN. Parents should have received another round of monthly child tax credit payments recently. Max refund is guaranteed and 100 accurate.

Taxpayers can get up to 3000 for the 2022 tax year if theyve got an unborn child with a detectable heartbeat between July 20 and Dec. Families are slated to receive 3600 for each child under the age of 6 and 3000 for each child between the ages of 6 and 17. See what makes us different.

Check from October 15 will be sent to millions of families. The fourth monthly payment will go out on October 15 so you should expect to receive either 300 or 250 dollars. Government check Getty Images.

CBS Detroit -- The Internal Revenue Service IRS sent out the fourth round advance Child Tax Credit payments on October 15. Families could be eligible to. IR-2021-153 July 15 2021.

The first three payments were. In terms of monthly payments families will receive their check for 300 for each child under 6 years old. The next child tax credit payment will be issued on October 15 2021.

October 15 2021 at 733 am. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. IR-2021-201 October 15.

The child tax credit scheme was expanded to 3600 from 2000 earlier this. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. October 15 2021 1242 PM CBS Chicago.

The IRS website provides additional information to confirm if citizens are eligible for the tax. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. October 29 2021 In October the IRS delivered a fourth monthly round of approximately 36 million Child Tax Credit payments totaling 15 billion.

October 15 Deadline Approaches for Advance Child Tax Credit. Have been a US.

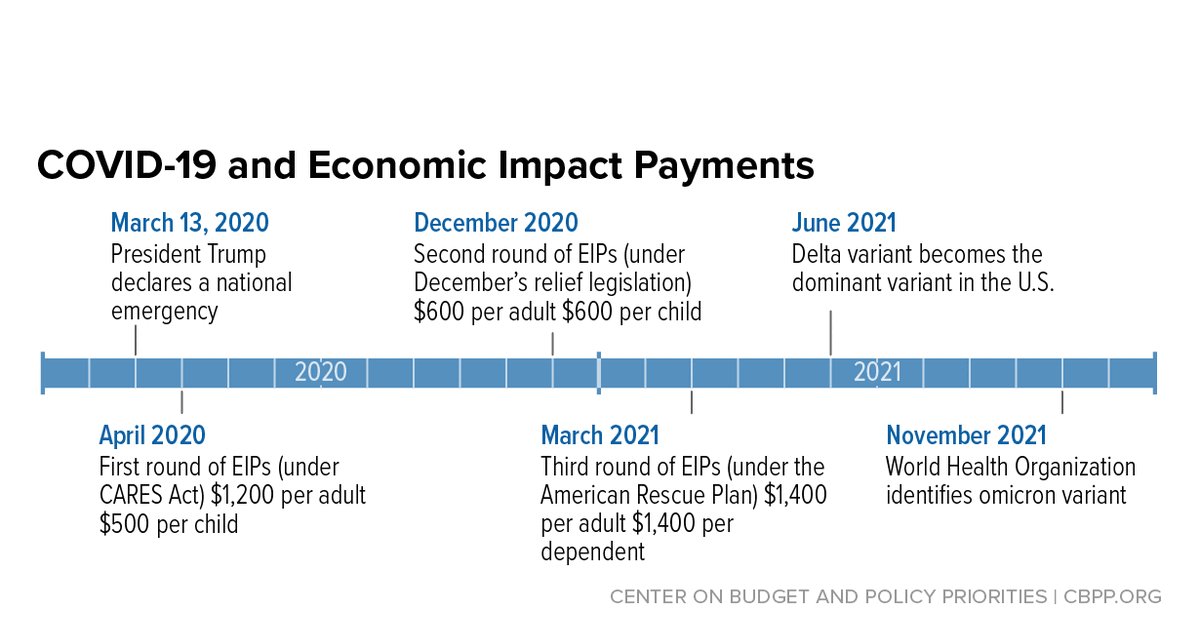

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

How Capital Gains From Mutual Funds Are Taxed In The U S In 2022 Mutuals Funds Mutual Funds Investing Bond Funds

Need Health Insurance Young Invincibles Health Insurance Plans How To Find Out Health Insurance

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

Neil Henderson On Twitter Cyber Attack Art Of Persuasion Financial Times

Tax Tip Tuesday In 2022 Tax Deductions Tax Payment Federal Income Tax

10 Off Any Service Repair 30 Off Tax Credit And More Tax Credits Grand Rapids Thermal

2021 Child Tax Credit Advanced Payment Option Tas

4 Tax Tips Every Small Business Needs To Know Marcellous Curtis Business Method Employee Retention Irs Taxes

Neil Henderson On Twitter Mtv Awards Bbc News Bbc

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

An Extension To File Your Taxes Is Not An Extension To Pay Tax Attorney Nick Nemeth Tax Attorney Filing Taxes Tax Deadline